All Three Credit Bureaus Addresses

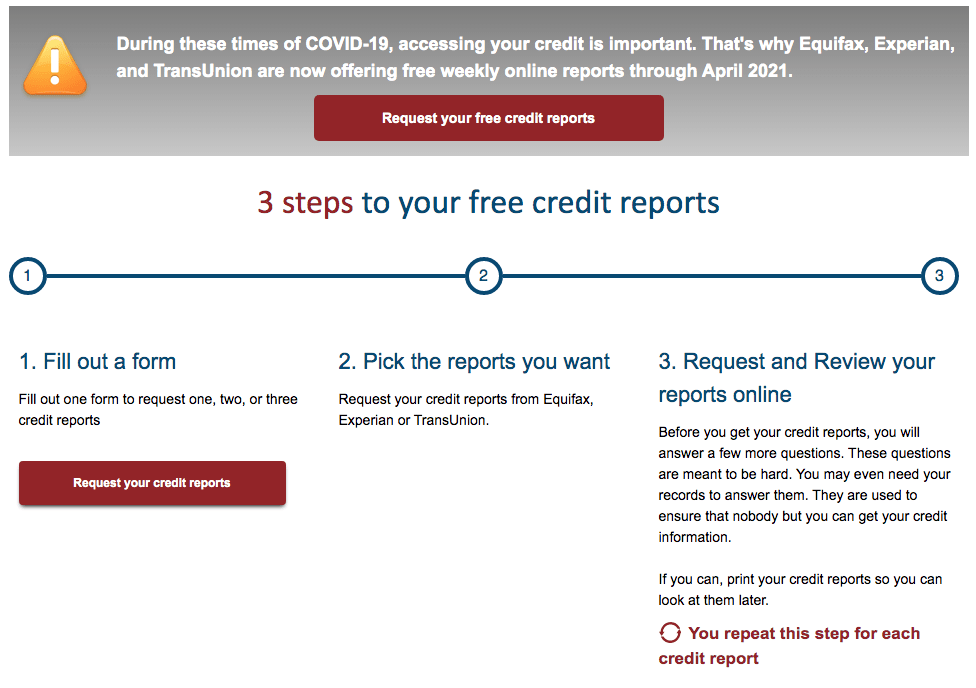

By law, under the Fair Credit Reporting Act you are entitled to a free copy of your credit report annually from each of the three major credit bureaus (Experian, Equifax, and TransUnion). In addition, several states offer an additional free credit report per year, including. FREE Credit Reports. Federal law allows you to: Get a free copy of your credit report every 12 months from each credit reporting company. Ensure that the information on all of your credit reports is correct. Call the Annual Credit Report service at (877) 322-8228 to request a free copy of all three of your credit bureau reports. Requesting a report online is helpful if you are not comfortable submitting your sensitive financial information online or via the mail. And it's still free. The three national credit reporting agencies—TransUnion, Experian and Equifax—are required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

Credit Scores and General Credit Information � The Facts You Need To Know

What is the Fair Credit Reporting Act, and how does it affect me?

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies such as Experian, TransUnion and Equifax. There are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about check writing histories, medical records, and rental history records). You must be told if information in your file has been used against you. Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment � or to take another adverse action against you � must tell you, and must give you the name, address, and phone number of the agency that provided the information. >> Learn more

Credit Check All Three Credit Bureaus Free

What are credit scores and why are they so important?

A credit score is a three-digit number that represents your total credit picture based on information contained in your credit files � including how respo nsible you have been paying your debts and bills, and the likelihood that you will meet your credit obligations. Your credit scores are based on many factors including your personal credit history, credit card accounts, and financial public records. Your scores are derived based on the credit information at the three major credit bureaus: Equifax, Experian and TransUnion. Your credit score is important because it tells a potential lender what kind of credit risk you are, which is why it�s important to know and understand all three of your scores. >> Learn more about your credit scores

Credit Freeze All Three Bureaus

What is a good credit score?

Credit scores typically range from 300 to 800 (depending on the scoring system), and your score could differ from bureau to bureau (Experian, TransUnion, Equifax), as creditors do not always report to all three. Typically, a good score is 720 or higher � meaning a lender will consider that person a low credit-risk in repaying a loan. You want the highest score possible to better secure a loan or a favorable interest rate. It is important to monitor your credit scores periodically. Checking your own scores will not lower your credit rating. >> Learn more about credit score ratings

Organic chemistry solutions manual. Organic Chemistry Student Solution Manual David Klein download Z-Library. Download books for free. Amazon.com: Organic Chemistry Study Guide and Solutions Manual, Books a la Carte Edition (178): Bruice, Paula: Books. Student's Solutions Manual for Organic Chemistry 9th Edition by Leroy Wade (Author), Jan Simek (Author) 4.4 out of 5 stars 144 ratings. Why is ISBN important? This bar-code number lets you verify that you're getting exactly the right version or edition of a book. The 13-digit and 10-digit.

Will my credit score be the same at each of the three primary credit bureaus (Experian, TransUnion, and Equifax)?

Feather 7 days to die. Not necessarily. Your credit score at each of the bureaus can vary, sometimes considerably (e.g. around 100 points). This can make the difference between being approved or denied for a loan, job, or new credit card. You never know which score a lender is going to check. This is why it�s important to know and understand your credit score and rating at each of the primary credit bureaus. If one of your scores is significantly different � either through error or omission of information � understanding the problem will enable you to address it directly with the bureaus (or bureaus) at hand. >> Learn more about the credit bureaus

All Three Credit Bureaus Free Credit Report

All Three Credit Bureaus Addresses

By law, under the Fair Credit Reporting Act you are entitled to a free copy of your credit report annually from each of the three major credit bureaus (Experian, Equifax, and TransUnion). In addition, several states offer an additional free credit report per year, including. FREE Credit Reports. Federal law allows you to: Get a free copy of your credit report every 12 months from each credit reporting company. Ensure that the information on all of your credit reports is correct. Call the Annual Credit Report service at (877) 322-8228 to request a free copy of all three of your credit bureau reports. Requesting a report online is helpful if you are not comfortable submitting your sensitive financial information online or via the mail. And it's still free. The three national credit reporting agencies—TransUnion, Experian and Equifax—are required by federal law to provide you with a free annual credit report. In fact, AnnualCreditReport.com was created by the credit reporting agencies as a one-stop-shop to provide you with your annual credit reports.

Credit Scores and General Credit Information � The Facts You Need To Know

What is the Fair Credit Reporting Act, and how does it affect me?

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies such as Experian, TransUnion and Equifax. There are many types of consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies that sell information about check writing histories, medical records, and rental history records). You must be told if information in your file has been used against you. Anyone who uses a credit report or another type of consumer report to deny your application for credit, insurance, or employment � or to take another adverse action against you � must tell you, and must give you the name, address, and phone number of the agency that provided the information. >> Learn more

Credit Check All Three Credit Bureaus Free

What are credit scores and why are they so important?

A credit score is a three-digit number that represents your total credit picture based on information contained in your credit files � including how respo nsible you have been paying your debts and bills, and the likelihood that you will meet your credit obligations. Your credit scores are based on many factors including your personal credit history, credit card accounts, and financial public records. Your scores are derived based on the credit information at the three major credit bureaus: Equifax, Experian and TransUnion. Your credit score is important because it tells a potential lender what kind of credit risk you are, which is why it�s important to know and understand all three of your scores. >> Learn more about your credit scores

Credit Freeze All Three Bureaus

What is a good credit score?

Credit scores typically range from 300 to 800 (depending on the scoring system), and your score could differ from bureau to bureau (Experian, TransUnion, Equifax), as creditors do not always report to all three. Typically, a good score is 720 or higher � meaning a lender will consider that person a low credit-risk in repaying a loan. You want the highest score possible to better secure a loan or a favorable interest rate. It is important to monitor your credit scores periodically. Checking your own scores will not lower your credit rating. >> Learn more about credit score ratings

Organic chemistry solutions manual. Organic Chemistry Student Solution Manual David Klein download Z-Library. Download books for free. Amazon.com: Organic Chemistry Study Guide and Solutions Manual, Books a la Carte Edition (178): Bruice, Paula: Books. Student's Solutions Manual for Organic Chemistry 9th Edition by Leroy Wade (Author), Jan Simek (Author) 4.4 out of 5 stars 144 ratings. Why is ISBN important? This bar-code number lets you verify that you're getting exactly the right version or edition of a book. The 13-digit and 10-digit.

Will my credit score be the same at each of the three primary credit bureaus (Experian, TransUnion, and Equifax)?

Feather 7 days to die. Not necessarily. Your credit score at each of the bureaus can vary, sometimes considerably (e.g. around 100 points). This can make the difference between being approved or denied for a loan, job, or new credit card. You never know which score a lender is going to check. This is why it�s important to know and understand your credit score and rating at each of the primary credit bureaus. If one of your scores is significantly different � either through error or omission of information � understanding the problem will enable you to address it directly with the bureaus (or bureaus) at hand. >> Learn more about the credit bureaus

All Three Credit Bureaus Free Credit Report

Credit Beauer Freeze Credit

Why should I monitor my credit scores?

Early signs of credit fraud and identity theft can often be spotted in your credit profile. The problem is that unless you check your credit information regularly, you may not be aware that someone opened a credit card in your name, or used your personal information to apply for a loan. That's why automatic monitoring of your credit files provides an ideal 'early warning' system, immediately alerting you to new inquiries, just-opened accounts and certain information. By monitoring your credit files, you could find out about these types of changes quickly, and take action as necessary. >> Learn more about credit monitoring

What is identity theft, and how can reviewing my credit scores help prevent it?

Unexpected changes to your credit score and information can indicate identity theft or credit fraud. According to the FTC website: Identity theft occurs when someone uses your personally identifying information like your name, Social Security number or credit card number without your permission, to commit fraud or other crimes. Once an identity thief gets a hold of your credit card information for example, they can open another card for their use, even changing the billing address so that you might not know for months that they're racking up charges. Understanding changes to your credit scores � based on data at Experian, TransUnion, and Equifax � can help you identify and guard against potential identity theft and fraud. Significant changes to your scores can indicate signs of fraud and theft. >> Learn more about identity theft

Lirik 'Love Of My Life' dari Dewi Dewi ini dipublikasikan pada tanggal 26 Juni 2007 (13 tahun yang lalu).Single ini didistribusikan oleh label Pelangi Records. Sebelumnya, lagu ini pernah dibawakan oleh Queen. Berikut cuplikan syair nyanyian / teks lagunya 'You've broken my heart and now you leave me / Because you don't know - / You've stolen my heart and now desert me / Because you. Love Of My Life 38. Separuh Nafas 39. Cukup Siti Nurbaya 40. Ini Gila Ini Cinta 42. Aku Bukan Cabe Cabean 43. Mengapa Oh Mengapa 46. Sang Penggoda 49. Risalah Hati 50. Dewi Dewi NonStop Full Album 51. Mahadewi NonStop Full Album Daftar Lagu Dewi Dewi / Mahadewi Tanpa Vokal. Download lagu love of my life versi dewi dewi.